By Gambo Jagindi

Economic development: NOA urges Nigerians to embrace financial services

The National Orientation Agency (NOA), has advised Nigerians to embrace Financial services that complement traditional banking system, Other Financial services that Nigerians should embrace include banking systems such as the, ATM, POS, Insurance, Pension services and others.

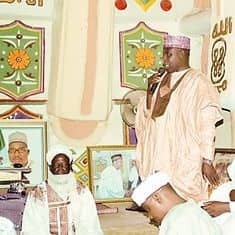

Bauchi State Director of NOA, Alhaji Nuru Kobi, gave the charge when the Financial Inclusion Strategy Committee visited the Emir of Bauchi, Alhaji Rilwanu Adamu.

According to Kobi, about 46.3 per cent of the Nigerian population was excluded from complete financial services.

He stressed the need to address this deficit if Nigeria intended to accelerate economic development.

He said the committee was at the emir’s palace to seek royal blessings to achieve its mandate of sensitising the public on the importance of financial inclusion to economic growth.

Kobi explained that the CBN in collaboration with other stakeholders, Launched the National Financial Inclusion Strategy Committee aimed at reducing the exclusion rate to 20% by 2020.

He said this was to enable adult Nigerians access banking services, that will aid small businesses through accessing loans and other financial services.

According to him, it will opens doors for families to invest, access credit facility for business expansion, open new economic opportunity and create jobs for many unemployed Nigerians.

Kobi solicited for the royal father’s support, particularly in the area of creating awareness.

Also speaking during the visit, the representative of CBN, Alhaji Aminu Sule, said that CBN introduced the cashless policy to enable people carry out financial transactions without the hard cash.

Sule said it would reduce leakages and save money for vital development.

Responding, Adamu thanked the Committee for the visit and promised to join hands with the committee to sensitise his subjects on the need for every adult to access financial services.

The monarch stressed the importance of making available and accessible financial services to the people.

Aluta News reports that the Committee is made of Representatives from relevant Government ministries, Departments, Agencies, Private Sector and the CBN.